Refinance two mortgages into one calculator

By default the table lists refinancing rates though you can click on the Purchase heading to see purchase money mortgages. If interest rates are on the decline it may be a good time to.

Home Loan Calculators And Tools Hsh Com

By paying a little extra on principal each month you will pay off the loan sooner and reduce the term of your loan.

. The national average annual percentage rate APR on a 30-year fixed mortgage refinance on December 3 2021 is 331 while the 15-year fixed mortgage refinance is 266. If you require a lower interest rate adjustable-rate mortgages ARM offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time usually 3 5 7 or 10 years. To remove a borrower from the.

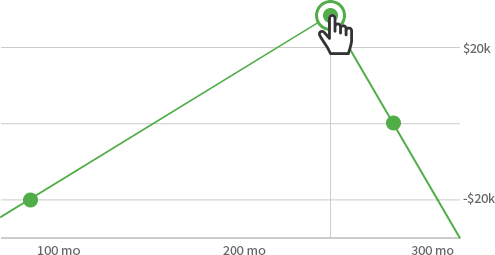

To Move into a Longer-Term Loan While refinancing into a mortgage with a lower interest rate can save you money each month be sure to look at the overall cost of the loan. For example adding 50 each month to your principal payment on the 30-year loan above reduces the term by 3 years and saves you more than 27000 in interest costs. Your home value has increased considerably.

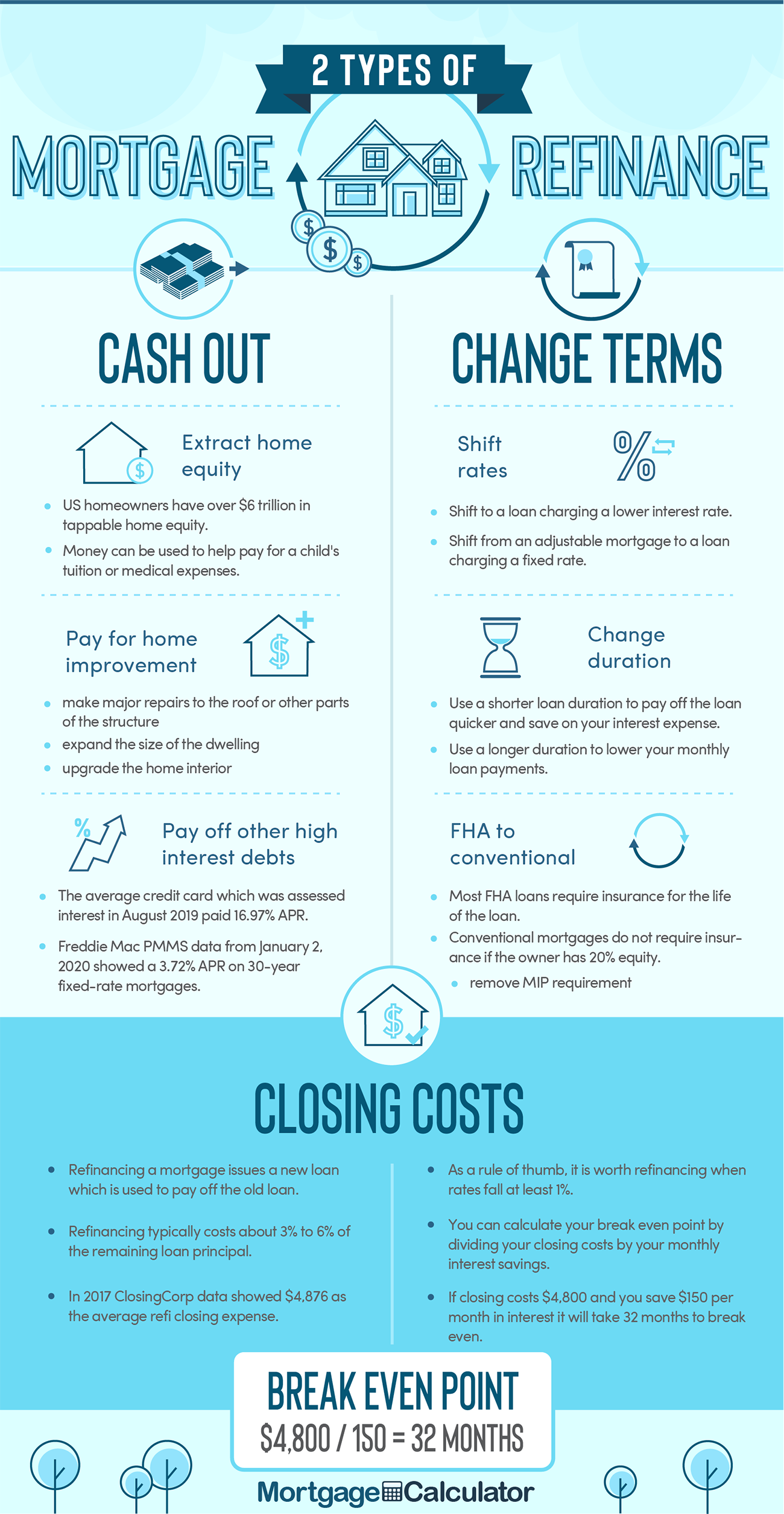

When interest rates drop consider refinancing to shorten the term of your mortgage and pay significantly. The average 15-year fixed refinance APR is 5380 according to Bankrates latest survey of the nations largest refinance lenders. Common Reasons to Refinance a Mortgage.

The following table highlights current Redmond mortgage rates. One of the biggest student loan myths out there is that borrowers can. There are pros and cons to a 15.

A cash-out refinance lets you tap your homes equity by replacing your existing mortgage with a new one for a larger loan amount taking the difference in cash. When shes not helping members into their first or new forever home Alicia is enjoying quality time with her two children and her family. When to consider a refinance of your reverse mortgage.

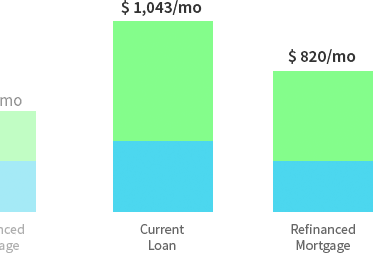

The mortgage calculator result helps Tom and Patty do two things. The calculator includes a colorful slider that displays the years remaining on your current. Refinance rates are very competitive with other mortgage lenders.

Consider refinancing your mortgage if you want to. First they can see how much their new mortgage payment is. Bryce Kingsley 608-243-5000 ext.

Take advantage of lower interest rates. Now the shorter 15-year term will make Tom and Pattys monthly payment go up from 1150 to about 1300 per month and itll make yours go up a. Current Redmond Mortgage Refinance Rates on a 260000 Fixed-rate Mortgage.

Use our Student Loan Calculator to see how much you could save by refinancing your student loans with SoFi. USAA offers a full range of mortgage refinancing options including cash-out refinancing. When you refinance from a 30-year mortgage into a 15-year loan you pay off the loan in half the time.

You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan. Getting a mortgage with a lower interest rate is one of the best reasons to refinance. As a result you pay less interest over the life of the loan.

Refinancing a mortgage or any other type of loan for that matter refers to the process of obtaining a new loan -- typically with better terms -- for the purpose of replacing an existing one. At Bankrate we strive to help you make smarter financial. Refinancing is not the only way to decrease the term of your mortgage.

Refinance options are the same as for mortgages to purchase a home including conforming VA FHA and jumbo mortgages with terms of 15- or 30-year fixed-rate loans or 5-year ARMs. The results of this calculator explain which one of the above categories your refinance would fit into. By refinancing into a longer term and taking advantage of monthly payment savings borrowers will generally pay more total interest over the life of the loan.

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

Mortgage Calculator Money

First And Second Mortgage Consolidation Refinance Calculator Refi Your First And Second Mortgages

Our Refinance Calculator Is It Time To Refinance Your Mortgage Moneygeek

Pin On Bbbbbank

Fha Loan Pros And Cons Fha Loans Fha Mortgage Home Loans

Our Refinance Calculator Is It Time To Refinance Your Mortgage Moneygeek

Do S And Don Ts When Purchasing A Home Mortgage Refinance Firstimehomebuyer Jumbo Purchase Fha Conventiona Reverse Mortgage Refinance Mortgage Mortgage

Downloadable Free Mortgage Calculator Tool

Mortgage Refinance Breakeven Calculator Should You Refi Your Home Loan

Home Mortgage Refinance Calculator Current Mortgage Loan Refinancing Rates

How To Get A Mortgage From Pre Approval To Closing Home Improvement Loans Mortgage Mortgage Loans

In This Busy World Making Both Ends Financially Meet Together Becoming Harder For Middle Class A Family Refinance Mortgage Second Mortgage Refinancing Mortgage

First And Second Mortgage Consolidation Refinance Calculator Refi Your First And Second Mortgages

First And Second Mortgage Consolidation Refinance Calculator Refi Your First And Second Mortgages

How To Calculate Equity In Your Home Nextadvisor With Time

Pin On Credit Scores Needed To Qualify For A Kentucky Fha Va Khs Usda And Rural Housing Mortgage Loans